Professional tax online payment method | Professional tax west bengal 2024

Last updated on November 29th, 2023 at 07:35 am

Professional tax online payment method | Professional tax west bengal:

Hi Readers, Today we are going to learn the procedure of the Professional tax online payment method. First, let’s understand what is Ptax? Professional Tax is levied by the state government under the Commercial tax department on individuals who earn by way of profession, trades, and employment subject to income exceeding a threshold set by the individual state. The amount of deduction differs from state to state as per the slabs fixed by the states. As per article 276 of the Constitution State can levy ptax to a maximum cap of Rs 2500 on any person.

Who is liable to pay ptax?

- An employer is required to deduct the ptax amount from the employee payable amount and pay the tax to the State Government on a monthly basis.

- An employer is also liable to ptax on his trade as per the tax slab provided by the government, which is generally paid on a yearly basis.

Thus it is required for an employer to obtain two registrations first a professional tax certificate to pay tax on his trade, and another, a professional tax enrolment certificate to be able to deduct tax from his employees and pay.

Slabs for PTAX in West Bengal:-

| Monthly Salary | Amount of tax to be deducted |

| Up to Rs 10,000/- | Nil |

| Rs 10,0001 to Rs 15,000/- | Rs 110 |

| Rs 15,0001 to Rs 25,000/- | Rs 130 |

| Rs 25,0001 to Rs 40,000/- | Rs 150 |

| Above Rs 40,001/- | Rs 200 |

Now let’s understand how to pay PTAX online AS PER the West Bengal government along with images of each step for easy reference.

Professional tax online payment method (Payment procedure of professional tax west bengal)

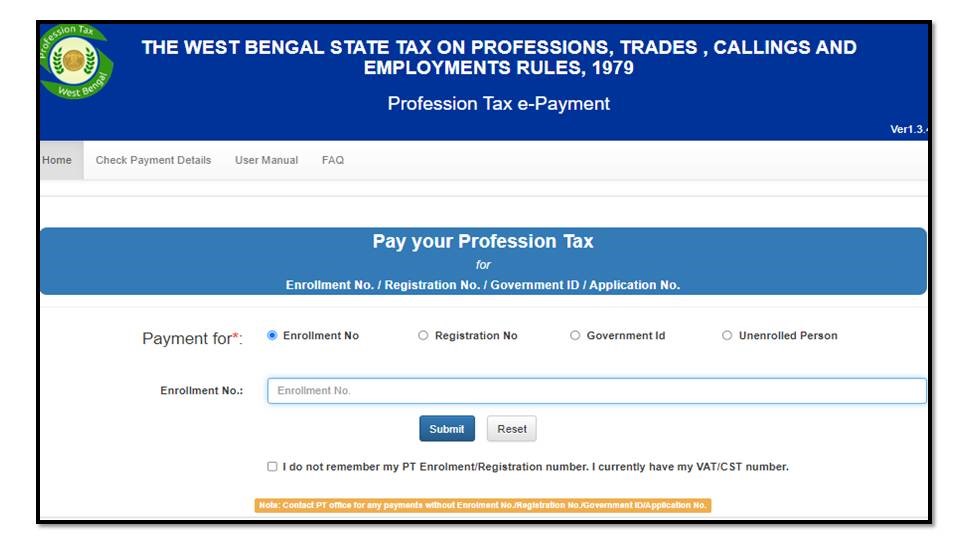

Step 1:- Firstly login into https://wbprofessiontax.gov.in/

Then under E-services go to the E-payment option as shown below

Step 2:-

Then login using your Registration number and Password.

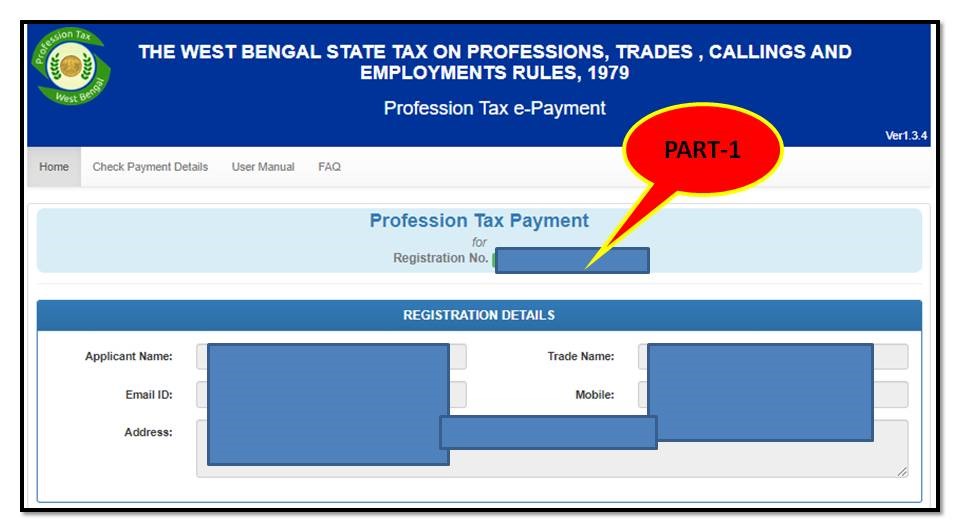

Step 3:- Once you login you will get to see all the details divided into 2 parts:-

Part 1- Name of company, Registered mail ID, and contact and enrollment number in the first part of the page displayed.

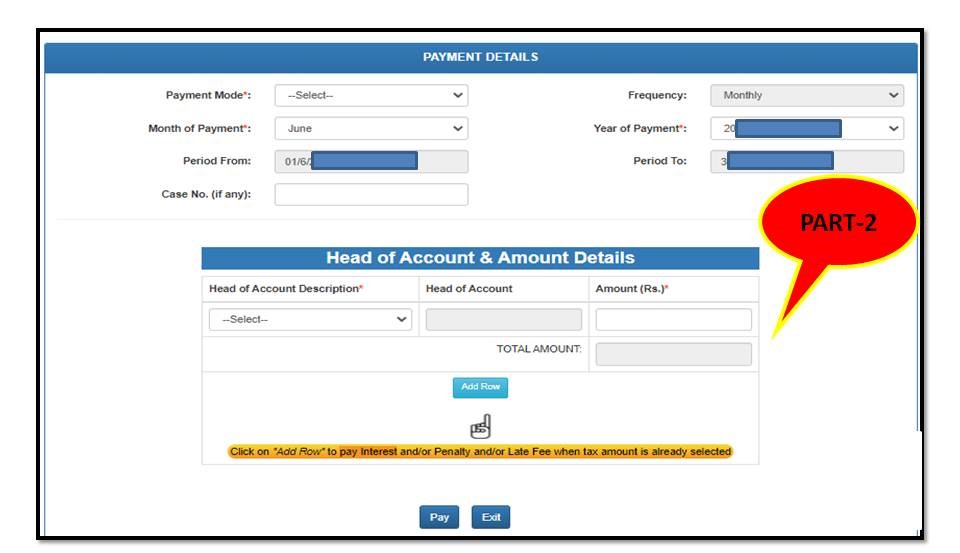

Part 2- In the second part you get the option of choosing the mode of payment, the month for which the payment is being done along with the year and amount.

After filling in those details click on the pay option.

Step 4:-

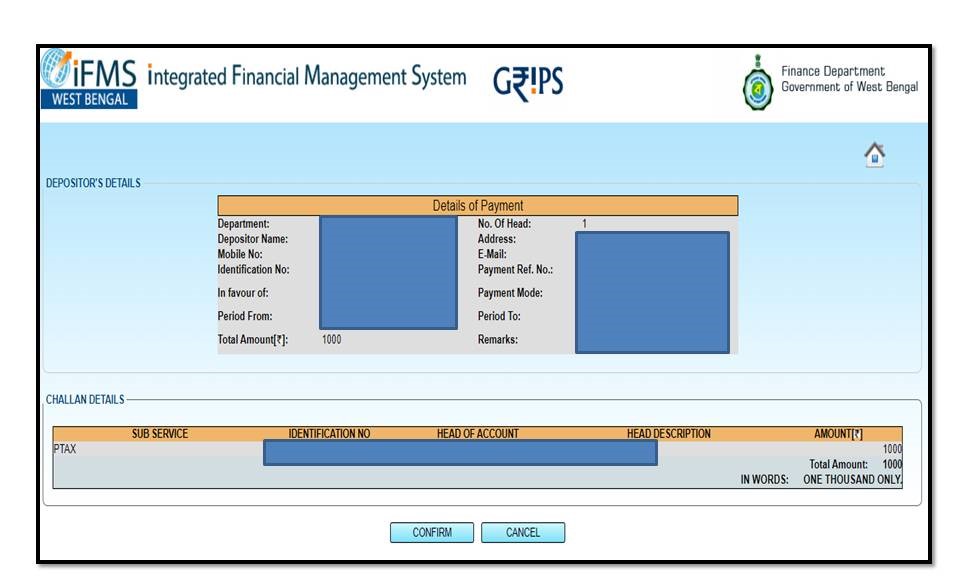

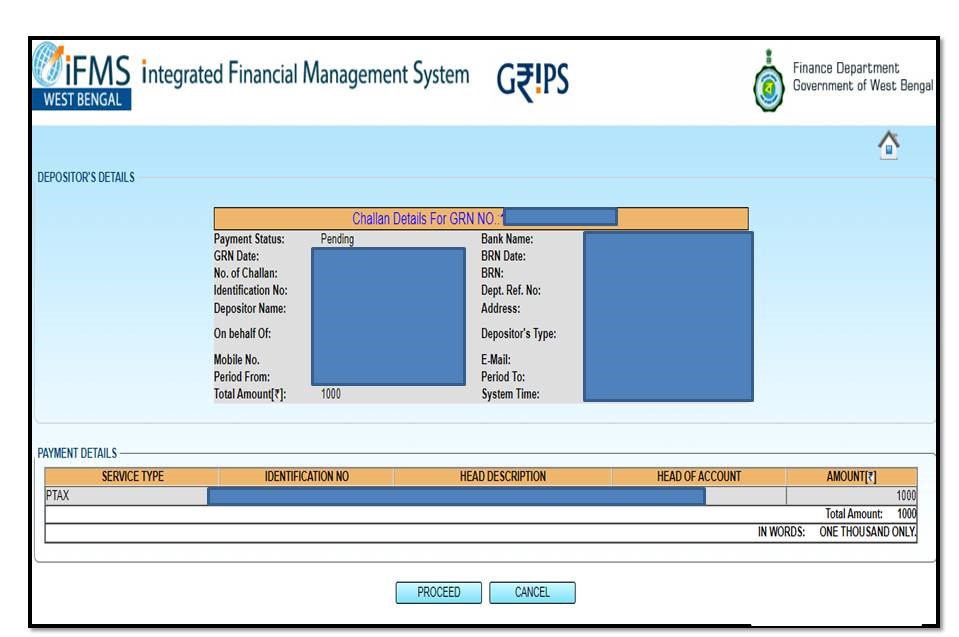

Details of payment will be displayed as per the image shown below click on confirm after verifying all the details.

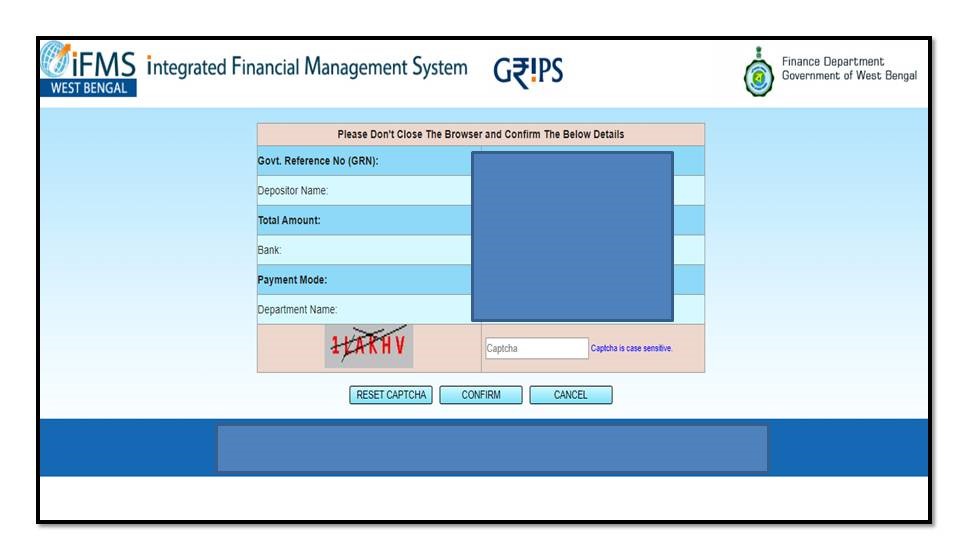

Step 5:- You will get a challan displayed with GRN number after clicking on proceed option. A page will be displayed to enter the captcha. Then, click confirm.

After completing all the above-stated steps. You will be provided with the option to select the bank for online transfer. Choose the bank . Login using your net banking user id and password and confirm the payment. You will get the paid challan displayed on the screen. Download the PDF file for future reference.

Similarly by following the same steps one can make the professional tax payment against the enrollment number for trade which is generally 2500/- p.a.

When to pay PTAX?

PTAX is paid annually in case of enrollment number for trade and monthly in case of the registration number. In case of late payment, the simple interest of @1% per month is levied on the defaulter of the same.

Disclaimer note: Source reference: Professional tax, west-bengal-https://wbprofessiontax.gov.in/.

Please visit and ensure the ptax slab, method, or process through source reference / official website. The author is not responsible for any loss at your end.

Thank you for reading…Keep visiting Techiequality.Com

Popular Post